Analysis of Trades and Trading Tips for the Euro

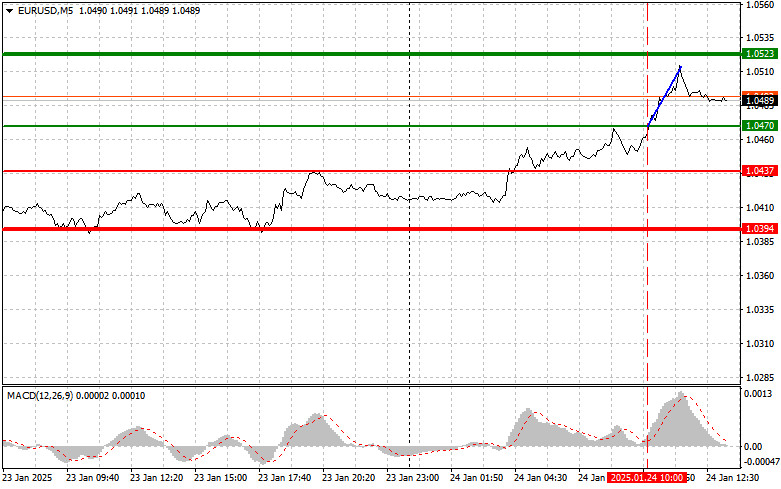

The test of the 1.0470 price level occurred when the MACD indicator had just started moving upward from the zero mark, combined with strong data from the Eurozone. This helped confirm the decision to buy the euro in continuation of the upward trend. As a result, the euro gained another 40 points, falling just short of the target level at 1.0523.

Considering the latest PMI data from the Eurozone, the euro is clearly benefiting from the current environment. While European countries continue to face economic challenges, including weak manufacturing activity, PMI data managed to support the euro, albeit temporarily. However, uncertainty about possible new tariffs from the Trump administration is adding nervousness to the markets. Investors are cautiously observing developments, fearing surprises that could destabilize the markets. This, in turn, affects trader activity, prompting the use of lighter trading strategies.

In the coming hours, attention will be focused on U.S. PMI data for the manufacturing and services sectors. These indicators are key barometers of economic health, reflecting business confidence and consumer demand trends. If the figures exceed expectations, they may signal a recovery in activity, positively impacting the dollar. While the current situation in the manufacturing sector remains unstable, if the new data confirms strengthening business confidence, it could lead to increased investment and job growth. Such developments could further strengthen the dollar and weaken the euro.

Buy Signal

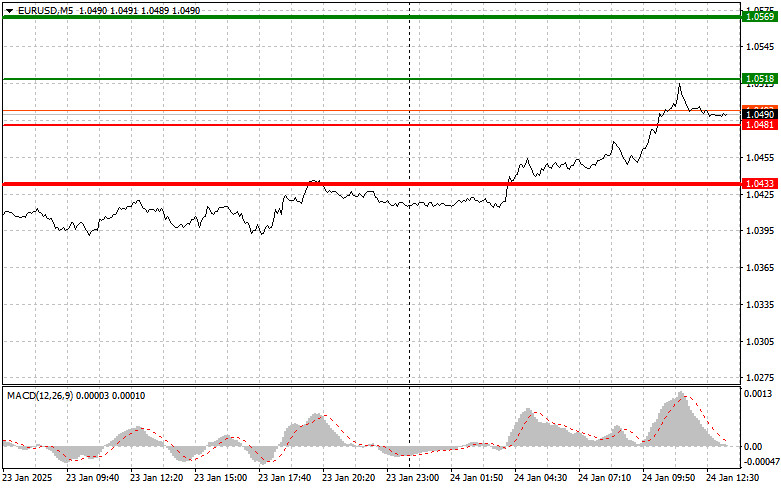

Scenario #1: Today, buying the euro is possible at the price level of 1.0518 (green line on the chart), targeting growth to 1.0569. At 1.0569, I plan to exit the market and sell the euro on a reversal, aiming for a 30–35-point move in the opposite direction from the entry point. Counting on euro growth today is only realistic if U.S. data comes in weak.Important! Before buying, ensure that the MACD indicator is above the zero mark and just start its upward movement from it.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0481 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. Growth toward the opposite levels of 1.0518 and 1.0569 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0481 level (red line on the chart). The target will be 1.0433, where I will exit the market and immediately buy in the opposite direction, aiming for a 20–25-point move in the opposite direction from the level. Selling pressure may return to the pair at any time.Important! Before selling, ensure that the MACD indicator is below the zero mark and just start its downward movement from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.0518 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downwards. A decline toward the opposite levels of 1.0481 and 1.0433 can be expected.

Chart Details:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Suggested price to place Take Profit or manually secure profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Suggested price to place Take Profit or manually secure profits, as further declines below this level are unlikely.

- MACD Indicator: Key for market entry, focusing on overbought and oversold zones.

Important Note for Beginner Forex Traders: Exercise extreme caution when deciding on market entries. Ahead of key fundamental reports, it's often better to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you risk quickly losing your entire deposit, especially if you trade in large volumes without proper money management.

And remember, successful trading requires a clear trading plan, such as the example provided above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.