The EUR/USD currency pair experienced an upward trend for most of the day on Monday. Notably, there were no specific events that seemed to trigger this movement. While both the European Central bank and Federal Reserve meetings are scheduled for this week, their outcomes were anticipated weeks ago. The main point of interest in these meetings will be the comments from Christine Lagarde and Jerome Powell. So, what else could have contributed to the euro's gains on Monday? There were no significant macroeconomic releases, and Lagarde's speech occurred much later than the euro's rise. Does this imply that Trump is once again to blame?

We do not agree with the notion that Trump is solely responsible for all market movements. In fact, the dollar had risen significantly for several months leading up to Trump's inauguration. Bitcoin has also been trading flat for several months, while major US stock indices are also flat. However, the dollar has been in decline for three consecutive weeks.

Two possible explanations come to mind. First, the correction we've been discussing for the past month may finally be taking place. A look at the daily timeframe indicates that a correction has been brewing for some time. Since we are analyzing a daily chart, this correction should be proportional to the previous movement, making the scale of the correction understandable. However, the speed of the euro's rise raises some questions; it is climbing too quickly. Corrections can manifest in various forms. While we did not anticipate such rapid growth, it does not change the fundamental nature of the correction.

It's challenging to determine exactly what major market participants anticipate from Trump, but their recent behavior—nearly panicking—suggests they are divesting in dollars in preparation for potential challenges. The intensity of dollar selling indicates that these market players expect unfavorable outcomes during Trump's leadership.

We share the viewpoint of these market participants. If Trump were a "dark horse", it might be possible to speculate on his potential policies. However, he has already served as president for four years, and the world has witnessed his governing style firsthand. While the United States is a global superpower with one of the strongest economies, it can operate from a position of strength. But does this approach align with democratic and humanitarian principles? In essence, if a country's actions are driven solely by its power, how is the U.S. fundamentally different from North Korea?

Both reasons may currently apply. Is it a technical correction? Yes. Is it wise to move away from the dollar due to concerns about Trump? Also yes. We will observe and see.

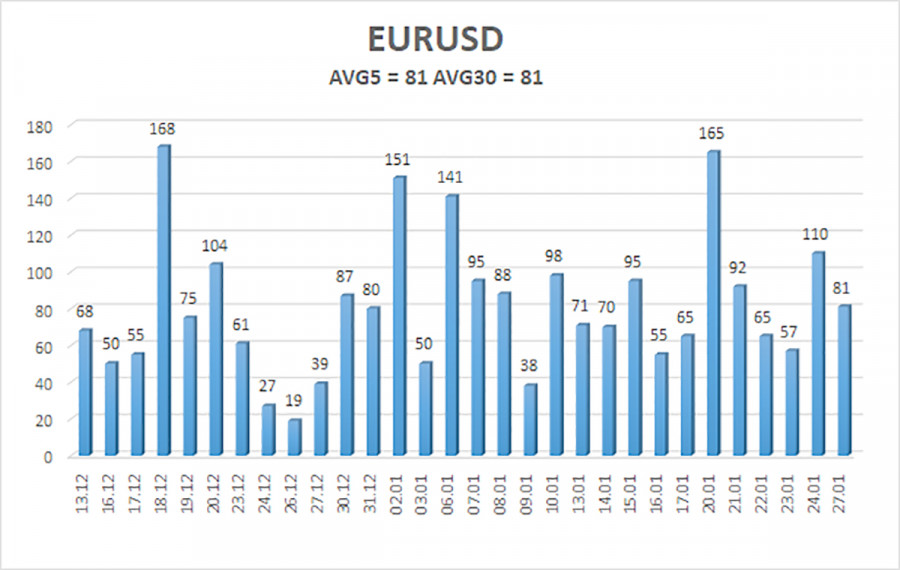

The average volatility of the EUR/USD currency pair over the last five trading days as of January 28 is 81 pips, categorized as "medium." On Tuesday, we expect the pair to move between the levels of 1.0426 and 1.0588. The higher linear regression channel remains downward, signaling a continuation of the global bearish trend. The CCI indicator has entered the overbought zone, warning of a potential resumption of the downtrend. A bearish divergence may also form, which could trigger a new decline.

Nearest Support Levels:

- S1: 1.0498

- S2: 1.0437

- S3: 1.0376

Nearest Resistance Levels:

- R1: 1.0559

- R2: 1.0620

- R3: 1.0681

Trading Recommendations:

The EUR/USD pair is currently experiencing an upward correction. Over the past few months, we have consistently anticipated a medium-term decline in the euro, and we believe this downtrend is not yet finished. While the Fed has paused its monetary policy easing, the European Central Bank is intensifying its strategies. As it stands, the dollar lacks significant reasons for a medium-term decline, apart from purely technical and corrective factors.

Short positions remain relevant, with targets set at 1.0254 and 1.0193. However, it is important to note that the current correction must first come to an end, which may happen near the 1.0640 level. If you trade based on "pure" technical analysis, long positions may be considered if the price moves above the moving average, with targets at 1.0559 and 1.0588. Nonetheless, any growth at this stage is classified as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.