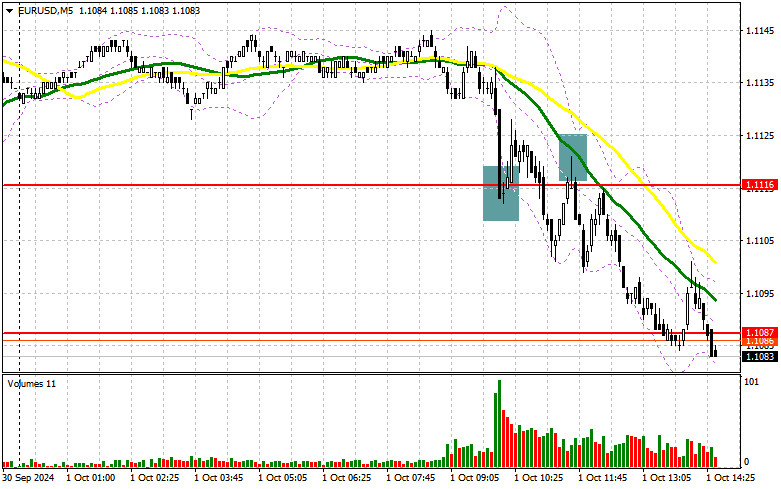

In my morning forecast, I focused on the 1.1116 level and planned to base my market entry decisions on it. Let's take a look at the 5-minute chart and analyze what occurred. The initial decline, followed by the formation of a false breakout, created a buying opportunity for the euro. However, after a 15-point rise, pressure on the pair resumed. A breakout and a subsequent retest of the 1.1116 level signaled further selling of the euro in line with the downward trend, leading to a drop toward the 1.1087 level. The technical picture was slightly revised for the second half of the day.

To Open Long Positions on EUR/USD:

Manufacturing activity in the eurozone was predictably disappointing, and now much will depend on the corresponding data from the US. We expect the ISM Manufacturing Index data for September, which has indicated certain issues, and a decline in this index could be a reason to buy the euro. We will also receive data on job openings and labor turnover from the Bureau of Labor Statistics, followed by speeches from FOMC members Raphael Bostic and Lisa D. Cook, which could potentially renew demand for the dollar.

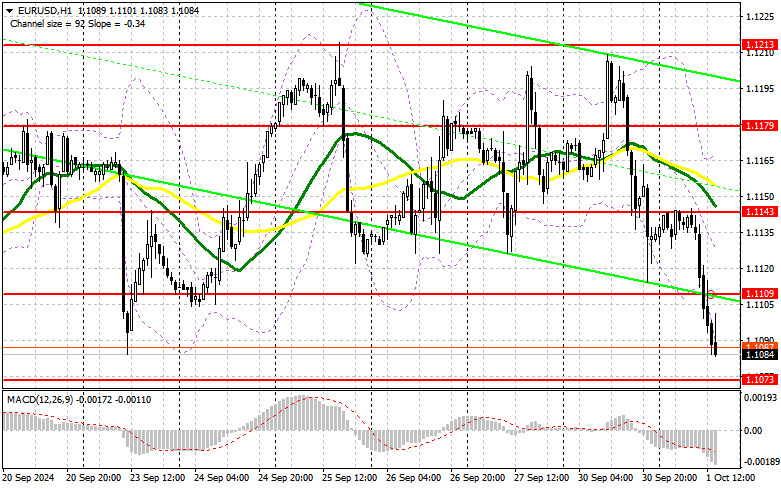

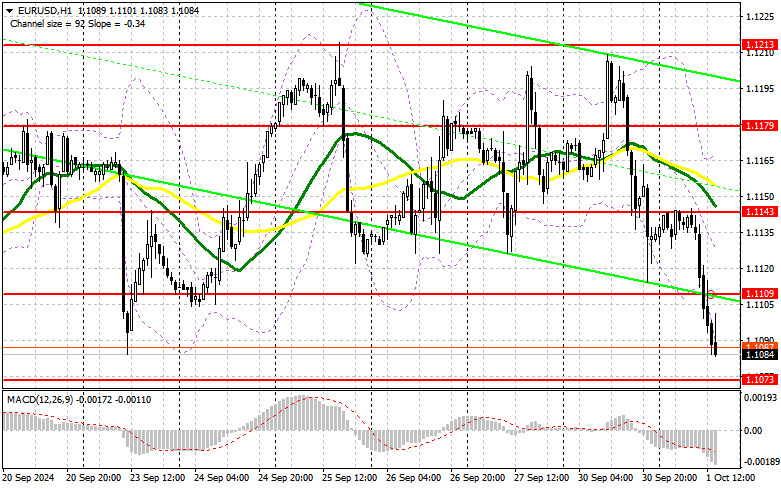

In the event of a bearish reaction to the speeches and strong U.S. data, only a false breakout formation around 1.1073 would provide a suitable condition for opening new long positions, aiming for a return to 1.1109—resistance established earlier today. A breakout and a retest from top to bottom of this range could lead to an increase in the pair, potentially reaching 1.1143. The furthest target would be the 1.1179 high, where I'll take profits.

If EUR/USD declines and there's no activity around 1.1073 in the second half of the day, the pressure on the pair will likely increase, leading to a larger sell-off at the start of the month. In such a case, I'll consider entering long positions only after a false breakout forms around the next support level at 1.1033. I'll open long positions immediately if the price rebounds from the 1.1004 level, aiming for a 30-35 point intraday upward correction.

To Open Short Positions on EUR/USD:

Sellers have an opportunity to push the euro lower, especially after the morning sell-off and Powell's comments yesterday. If there's no strong upward reaction following the ISM data today, I will focus on defending the 1.1109 resistance. Only a false breakout there would provide a suitable condition for opening short positions, aiming for a correction toward the 1.1073 support area, where I expect buyers to be more active.

However, a breakout and consolidation below 1.1073, followed by a retest from bottom to top, will provide another selling opportunity with a target at the 1.1033 level. The furthest target will be around 1.1004, which would completely invalidate all bullish plans for further growth. I will take profit at this level.

If EUR/USD rises and there's no bearish activity around 1.1109, the bulls might attempt to regain control of the market. In that case, I will hold off on selling until the next resistance level at 1.1143, where the moving averages are in favor of the sellers. I'll initiate selling there as well, but only after a failed consolidation. I'll open short positions immediately if the price rebounds from 1.1179, aiming for a 30-35 point downward correction.

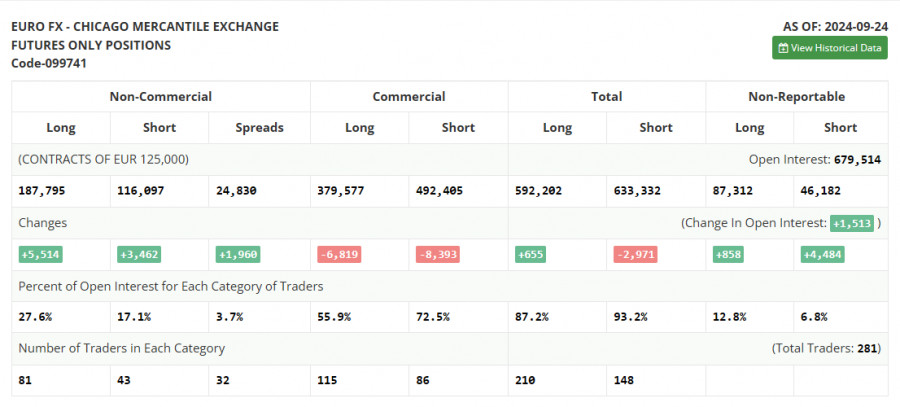

In the COT report (Commitment of Traders) for September 24, there was a slight increase in both long and short positions, maintaining the balance of power in favor of buyers of risk assets. It is evident that the Federal Reserve's decision to cut rates by 0.5% continues to attract new euro buyers to the market and prompts dollar selling, as the chances of more aggressive easing in November remain high. The future actions of the Fed will depend on the upcoming labor market data, which will be released in large volumes soon. I will rely on these when forming my euro strategy. However, the medium-term upward trend for the pair remains intact, and the lower the pair goes, the more attractive it becomes for buyers.

The COT report indicated that long non-commercial positions increased by 5,514 to 187,795, while short non-commercial positions grew by 3,462 to 116,097. As a result, the gap between long and short positions widened by 1,960.

Indicator Signals:

Moving Averages:

Trading is currently conducted below the 30 and 50-period moving averages on the H1 hourly chart, indicating a decline in the euro.

Note: The moving average periods and prices referenced by the author apply to the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.1080 will serve as support.

Indicator Descriptions:

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving Average: Defines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Tracks the convergence/divergence of moving averages. Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represents the total long open positions of non-commercial traders.

- Short non-commercial positions: Represents the total short open positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.